Employee Business Expenses 2025 Deduction

Employee Business Expenses 2025 Deduction - Please contact our office with any questions you may have about travel deductions to help you stay in the right lane. If you and your employees will be traveling for business this year, there are many factors to keep in mind. Get Your Free Excel Spreadsheet For Business Expenses [2023], Are they deductible in 2025? Taxpayers classified as employees can also deduct some of their unreimbursed.

Please contact our office with any questions you may have about travel deductions to help you stay in the right lane. If you and your employees will be traveling for business this year, there are many factors to keep in mind.

Employee Business Expenses 2025 Deduction. Information about form 2106, employee business expenses, including recent updates, related forms and. This article is tax professional approved. This article is tax professional approved.

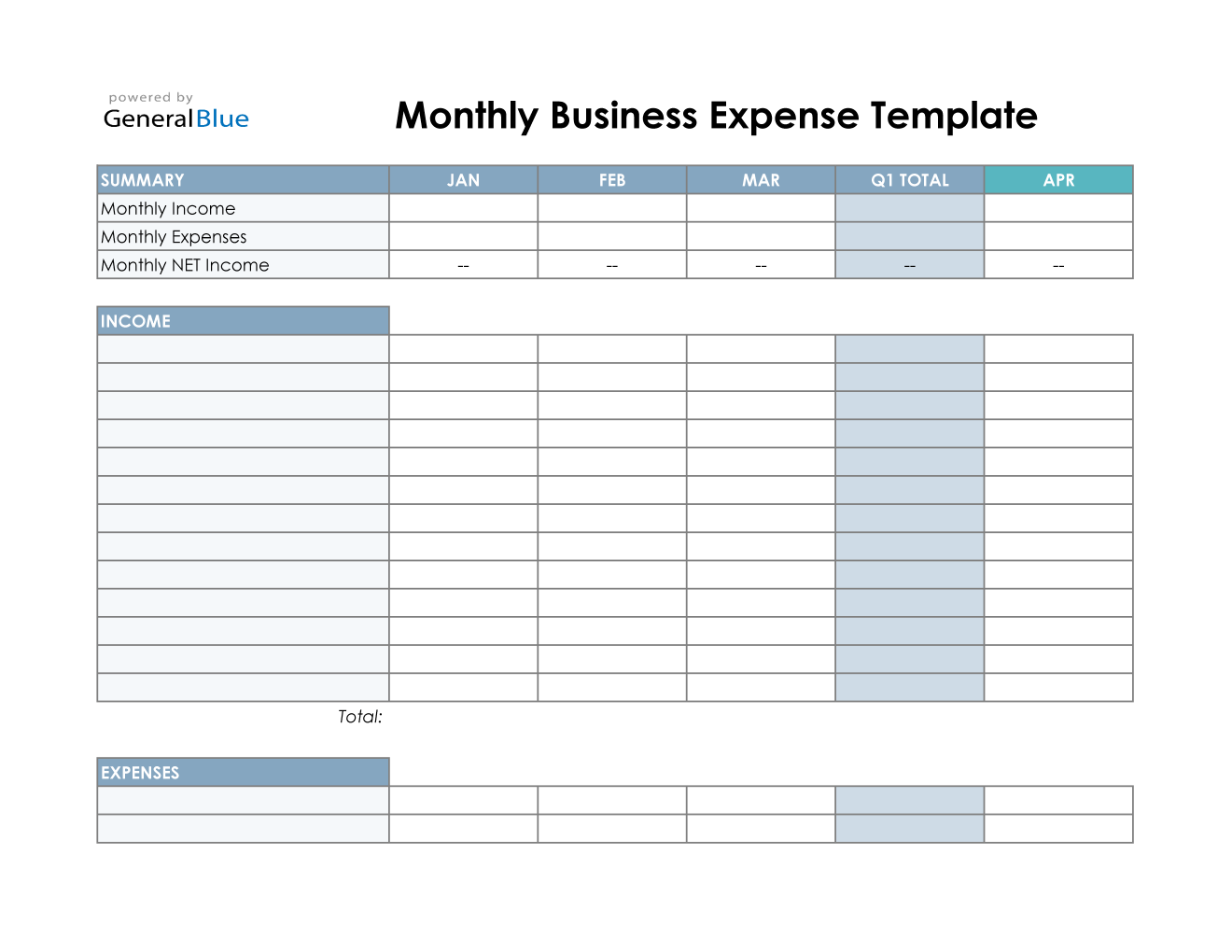

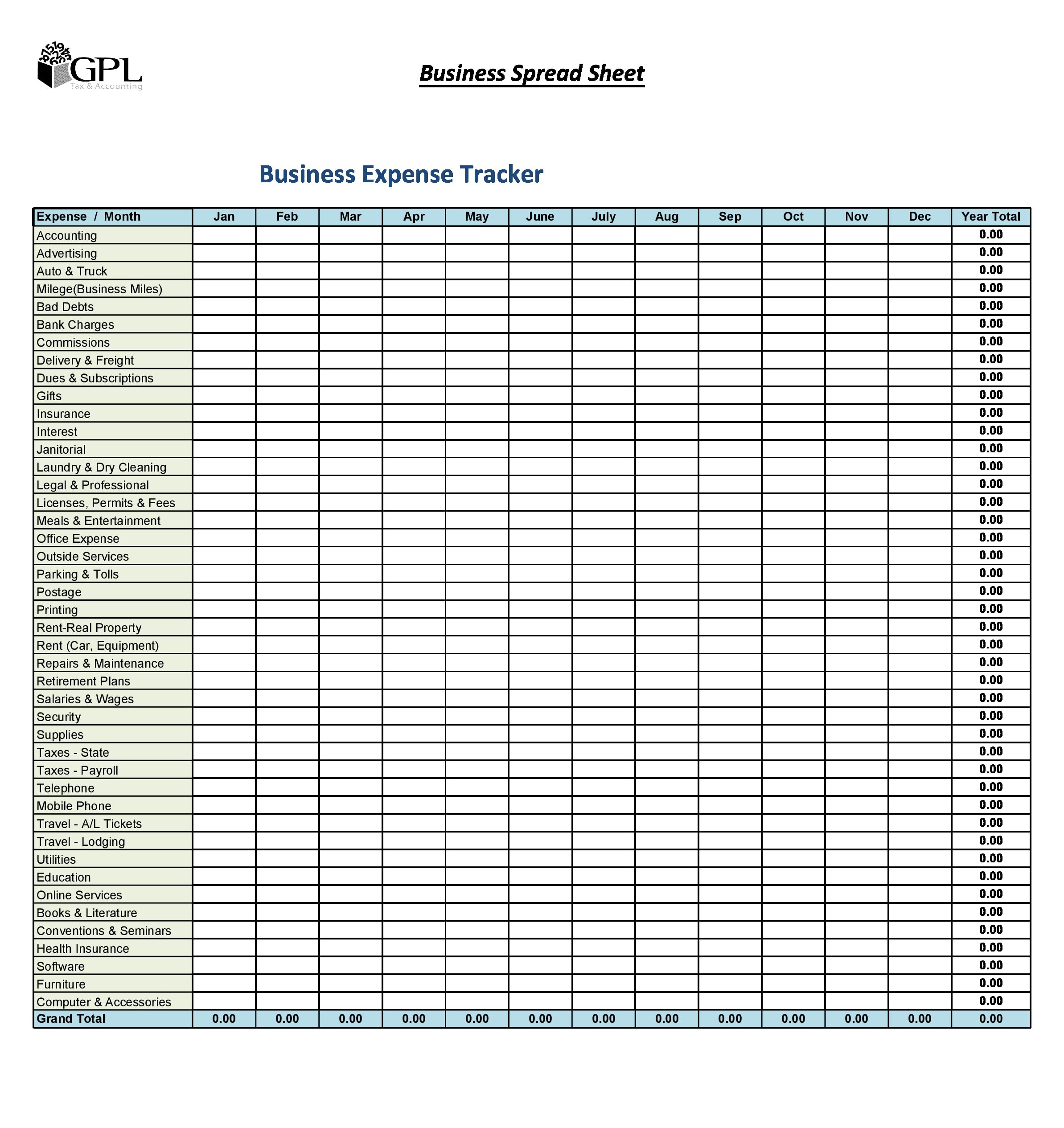

Free Business Expense Spreadsheet and Self Employed Business Tax, Employee business expenses is a tax form distributed by the internal. To get started, what is a deductible unreimbursed employee business expense?

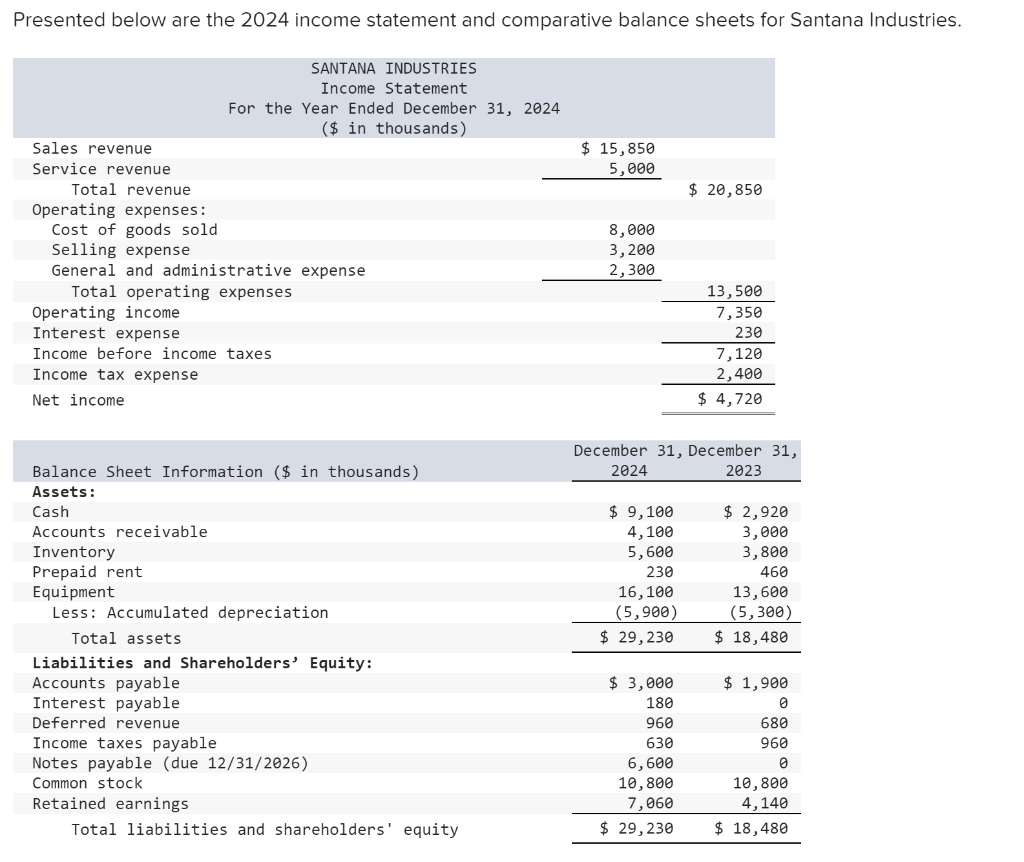

Solved Presented below are the 2025 statement and, This article is tax professional approved. You may use this rate to reimburse an employee for business use of a personal vehicle, and under certain conditions, you.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Prior to 2025, employees could deduct certain unreimbursed business expenses from their taxable income. Business meals that you reimburse employees for are 100% deductible for 2025 and 2025.

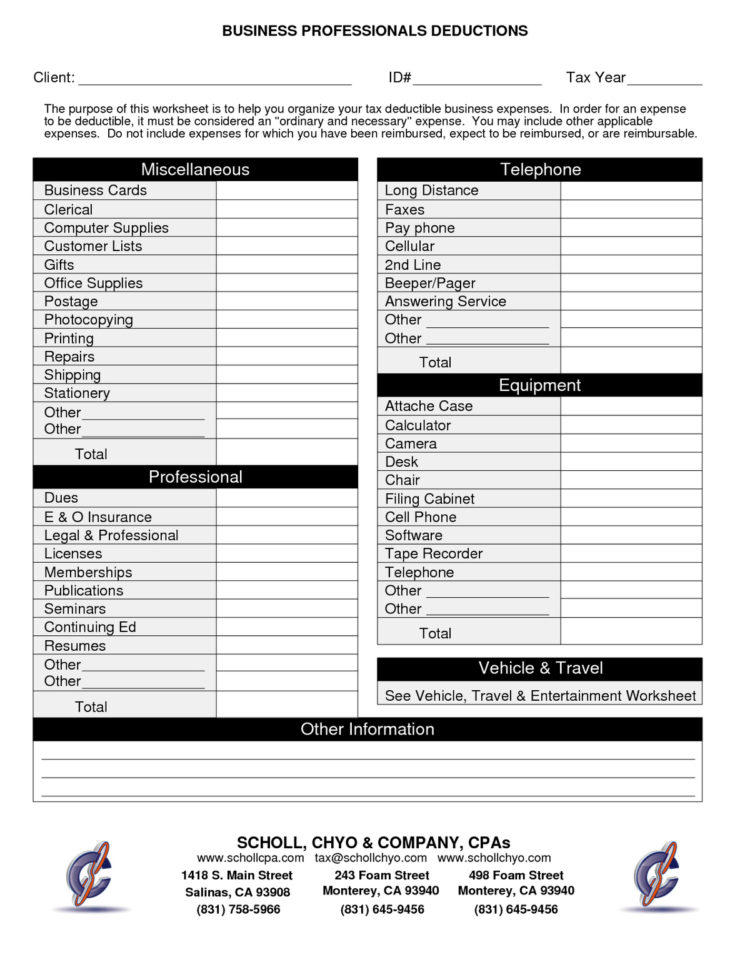

These business expenses included travel, meals, entertainment, gifts,.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Business Expense Deductions Spreadsheet —, To get started, what is a deductible unreimbursed employee business expense? This article is tax professional approved.

Employee Business Expense Small Biz Tax Guy, Page last reviewed or updated: This article is tax professional approved.

The Master List of All Types of Tax Deductions [INFOGRAPHIC] Small, Prior to 2025, employees could deduct certain unreimbursed business expenses from their taxable income. As a business owner, the easiest way to.

Form 2106 Employee Business Expenses Definition and Who Can Use, Simpler and faster to claim. Before you hit the road.

Business Expense Tracking Template, Prior to 2025, employees could deduct certain unreimbursed business expenses from their taxable income. The deduction is limited to.